Leasing demand continues to show strength in the office and industrial sectors, with companies moving within North Texas or entering the market. In both office and industrial, technology is an important factor for potential tenants as they seek better ways to communicate, do their work, and grow their businesses. E-commerce fulfillment is continuing to expand its presence in North Texas, according to CBRE Senior Vice President Steve Berger. Maps are provided by CBRE

ON-THE-GROUND INSIGHTS

“Technologically, tenants are seeking connectivity—reliable, fast, redundant internet service in the space and throughout the common areas of the building—as well as enhanced abilities to communicate and collaborate, and quality of life, convenience, and efficiency elements.”

— Steve Everbach, President, Central Region, Colliers International

“First and foremost, our clients want reliable, ubiquitous, and user friendly collaborative technology to enable their employees to do their best work, wherever they are. They want seamless integration between their smart phones and their office networks, eliminating those frustrating ‘friction points’ that occur as we move though our day on different networks and in different workspaces.”

— Lindsay Wilson, President, Corgan

“Advancement and broader adoption in the use of technology continues to feed the demand for industrial space within DFW. In particular, e-commerce fulfillment space is rapidly expanding as the adoption of mobile platform shopping proliferates and customers are more comfortable shopping for a wider array of products to be delivered to their doorstep.”

— Steve Berger, Senior Vice President, CBRE’s Industrial & Logistics practice

“It’s predicted that machines and automation will continue the push to replace warehouse personnel with robots in substantial numbers within the next five years. With Amazon leading the way in this trend in DFW, we are already seeing clear heights of newly constructed buildings spanning to 40 feet high.”

— Charles Brewer, Senior Associate, Industrial Services, Transwestern

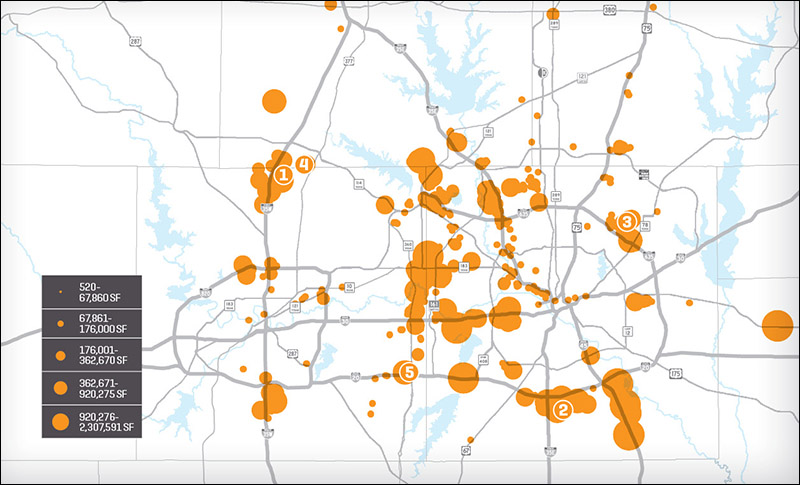

LARGEST INDUSTRIAL LEASES

1. LG ELECTRONICS

SIZE: 1.1 million square feet

LOCATION: Fort Worth

TENANT REPS: Craig Jones, Evan English, George Curry, Melissa Holland of JLL

DETAILS: The electronics company has leased the space at 14901 N. Beach St. in Fort Worth for a major distribution center. LG Electronics is a Korean electronics manufacturer and retailer.

2. ICU MEDICAL INC.

SIZE: 610,806 square feet

LOCATION: Lancaster

TENANT REPS: Caleb McCoy, Michael Haggar, Mitchell Lundquist, and Ryan Hawkins of JLL

DETAILS: San Clemente, Calif.-based ICU Medical leased an entire warehouse at 2801 N. Houston School Road in Lancaster. The company has operations across the globe and develops, manufactures, and sells medical tech used in vascular therapy, oncology, and critical care.

3. AT HOME

SIZE: 555,321 square feet

LOCATION: Garland

TENANT REP: Nathan Lawrence with CBRE

DETAILS: The home decor retailer has renewed its lease for the space at 4040 Forest Lane in Garland.

4. SCHLüTER-SYSTEMS

SIZE: 500,000 square feet

LOCATION: Fort Worth

TENANT REPS: Tom Pearson and Chris Teesdale of Colliers International

LEASING AGENTS: Hillwood

DETAILS: The global developer of innovative solutions for tile and stone installations has leased the space at Alliance Northport 1. The distribution center will serve central and southern states. It’s scheduled for completion in 2020 and should employ roughly 300 people.

5. LOCKHEED MARTIN

SIZE: 431,579 square feet

LOCATION: Fort Worth

DETAILS: Bethesda, Maryland-based Lockheed Martin Corp. signed a new 431,579-square-foot lease at the Fossil Creek Business Park in Fort Worth. Lockheed also fully leased 4501 New York Ave., a 175-536-square-foot building.

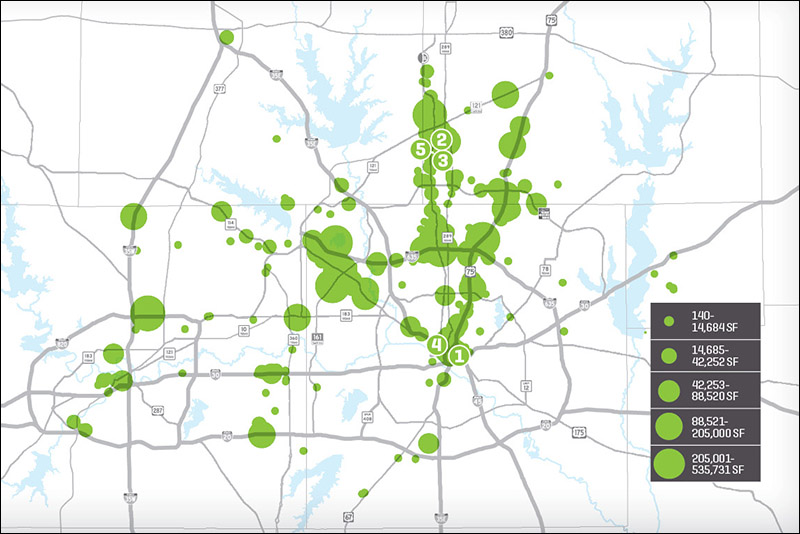

LARGEST OFFICE LEASES

1. UBER

SIZE: 617,089 square feet

LOCATION: Dallas

DETAILS: The San Francisco-based tech giant announced it will take the space in two office towers at The Epic development in Deep Ellum. It will be the second-largest Uber campus outside its California headquarters. Construction on the second tower, designed by Perkins+Will, will begin in the fourth quarter this year.

2. SPLUNK

SIZE: 84,000 square feet

LOCATION: Plano

TENANT REPS: John Wolf, Armand Tiano Jr., Jim Graham, and Tyler Howarth of Newark Knight Frank

LEASING AGENTS: Cushman & Wakefield

DETAILS: The San Francisco-based business IT and data services firm has leased the office space in Plano’s Legacy business park in the Gateway at Legacy building on the Dallas North Tollway.

3. NCR CORP.

SIZE: 52,551 square feet

LOCATION: Plano

TENANT REP: Doug Carigan and the late Steve Thelen of JLL

LEASING AGENTS: Doug Hanna and Tabitha Layne of Sunwest Real Estate Group

DETAILS: NCR signed a 52,551-square-foot renewal for office space at Tennyson Office Center, a two-building office development totaling 250,000 square feet at 6100 and 6200 Tennyson Parkway.

4. REED SMITH

SIZE: 49,000 square feet

LOCATION: Dallas

TENANT REPS: Philip Leibow, Brooke Armstrong, and Scott Have of JLL

LEASING AGENTS: Kelly Whaley and Hannah Waidmann of Harwood International

DETAILS: The international law firm has leased 49,000 square feet of office space at Harwood No. 10 in the Harwood District.

5. CRITICAL START

SIZE: 33,115 square feet

LOCATION: Plano

TENANT REP: Dan Polanchyk of Henry S. Miller

LEASING AGENTS: Doug Hanna and Tabitha Layne of Sunwest Real Estate Group

DETAILS: The technology company signed the new lease at Tennyson Office Center, a two-building office development totaling 250,000 square feet at 6100 and 6200 Tennyson Parkway.