Rising costs of materials and the availability of labor are having an impact on construction in North Texas, regardless of sector. In the office sector, architects and developers are striving to meet the challenge of producing quality projects amid an intense pace and pressure to deliver, says Jo Staffelbach Heinz, of DLR Group | Staffelbach. And with an election year looming in 2020, how will construction planning be affected?

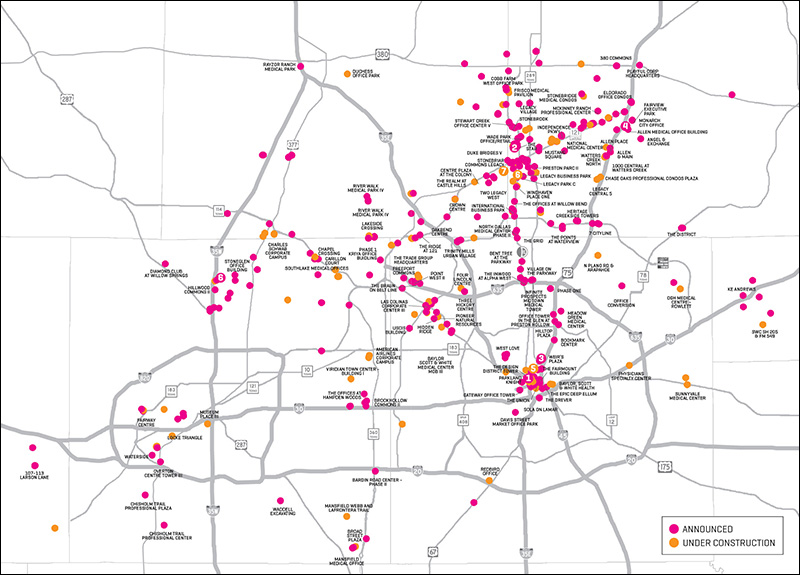

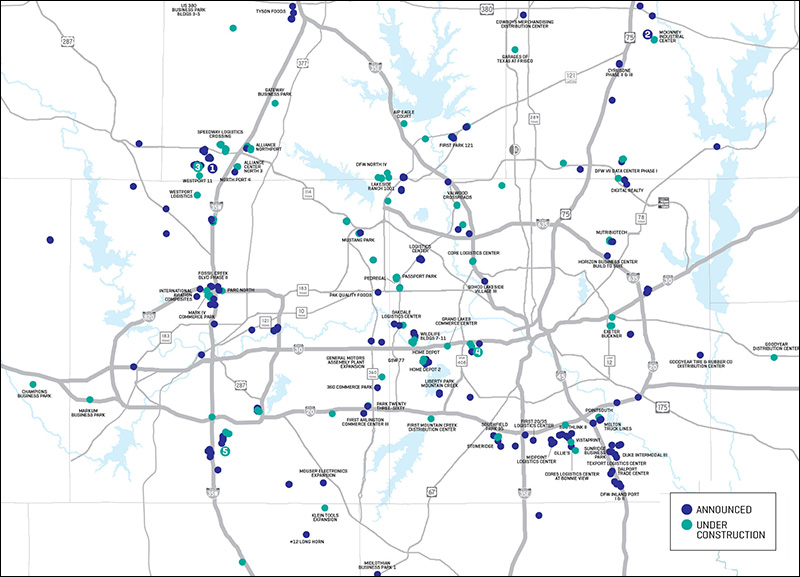

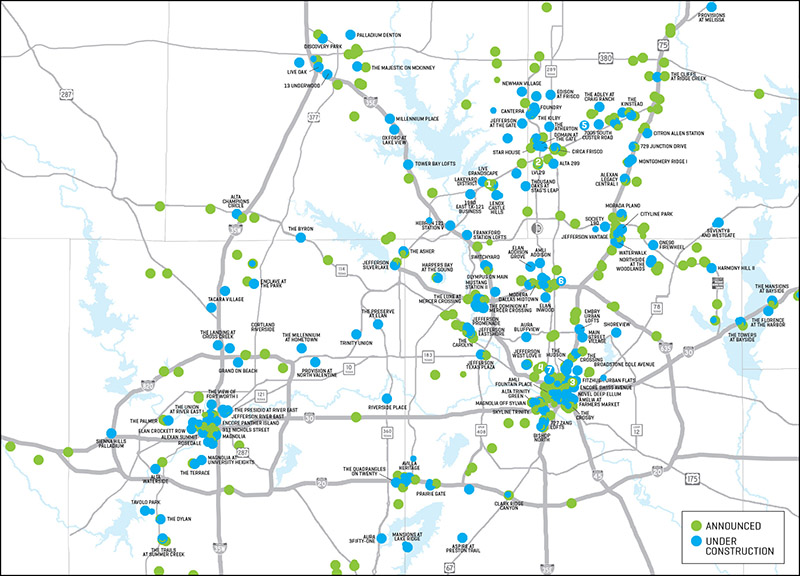

Maps for the office and industrial markets are provided by Transwestern. Data for the multifamily market is provided by Axiometrics, a RealPage company.

ON-THE-GROUND INSIGHTS

“Change is extensive! Office design is adapting to the evolving methods of working, new jobs, new industries and technology. Increased demand for construction materials and the availability and cost of labor has raised prices and expanded lead times. Quality remains challenging to obtain with the intense pace and pressure to deliver.”

— Jo Staffelbach Heinz, Principal/Regional Workplace Leader, DLR Group | Staffelbach

“We expect the escalation of construction costs to peak and begin to moderate, similar to standard inflationary increases. Labor constraints will continue to be the primary limiting construction factor in stretching out this growth cycle. With an election year approaching, we will probably see some brake-tapping on project launches while the world waits to see what happens.”

— Brad Blankenship, Executive Managing Director of Project and Development Services, Cushman & Wakefield Dallas

“The overall rising cost of delivery is the biggest trend. Tight labor, increased construction and material costs, along with elevated land prices are driving up overall project costs that are creating significant challenges to reach return thresholds by institutional owners/developers.”

— Caleb McCoy, Senior Associate, JLL

“Apartment dwellers want access to urban amenities that enhance their quality of life. Scooters, bikes, and ridesharing apps make travel simpler. Since cars are less important, developers are weighing options for future re-purposing of structured parking. They are also favoring more affordable single-bed units, including micro units of 300 to 450 square feet.”

— John Orfield, LEED AP, Partner, BOKA Powell

OFFICE

Announced Developments

1. VICTORY COMMONS

SIZE: 365,000 square feet

LOCATION: Victory Park, Dallas

DEVELOPERS: Hillwood Urban, USAA Real Estate

DETAILS: Construction has begun on this 15-story building on Victory Avenue across from the American Airlines Center arena. It’s next door to DART’s Victory Park commuter rail station and a new one-acre public plaza. Dallas-based architect BOKA Powell designed the project.

2. KEURIG DR PEPPER

SIZE: 350,000 square feet

LOCATION: The Star in Frisco

DETAILS: The beverage company has broken ground on its new headquarters building in Frisco, after announcing in February that it’s relocating the company from Plano. The new headquarters will be ready to occupy in 2021 and will serve as one of two company headquarters. The other is in Burlington, Massachusetts.

3. WEIR’S PLAZA

SIZE: 250,000 square feet

LOCATION: Dallas

DEVELOPER: Four Rivers Capital

DETAILS: The mixed-use retail and office development in the Knox-Henderson area already has signed the law firm Kirkland & Ellis as its anchor tenant on the top three floors, and coworking company WeWork has taken three other floors. The retail component will be anchored by a Weir’s Furniture store.

4. ONE BETHANY WEST

SIZE: 200,000 square feet

LOCATION: Allen

DEVELOPER: Kaizen Development Partners

DETAILS: Kaizen Development Partners has broken ground on its 200,000-square-foot, 8-story office building in Allen. Known as One Bethany West, the building is designed by BOKA Powell, with Balfour Beatty serving as general contractor. Completion is expected in 2020.

Under Construction

5. QUADRANGLE

SIZE: 335,000 square feet

LOCATION: Uptown Dallas

DEVELOPER: Stream Realty

DETAILS: Stream plans to add a new 12-story office tower at the north end of the existing Quadrangle site, home to an 8-story structure, Theater Three, and existing retail space. The new structure will include additional retail space, too. Omniplan is the architect on the project. Construction is set to begin in the middle of next year, and the tower is expected to be ready for tenants by 2022.

6. LEGACY IN PLANO

SIZE: 300,000 square feet

LOCATION: Legacy business park in Plano

DEVELOPER: Cawley Partners

DETAILS: The 15-story high-rise on Legacy Drive will be on a 100-acre mixed-use site in the Campus at Legacy West development, a part of the old J.C. Penney headquarters site.

7. TWO LEGACY WEST

SIZE: 300,000 square feet

LOCATION: Plano

DEVELOPER: Gaedecke

DETAILS: The 16-story, 300,000-square-foot office building will be constucted next to Gaedecke’s first-phase building, which has such tenants as NTT Data, coworking firm Venture X, Softweb Solutions Inc., and Tokio Marine Holdings.

INDUSTRIAL

Announced Projects

1. ALLIANCETEXAS

SIZE: 1.3 million square feet

LOCATION: Fort Worth and Northlake

DEVELOPER: Hillwood

DETAILS: The developer will build two new spec industrial buildings totaling approximately 1.3 million square feet in the AllianceTexas development in Denton County. Alliance Center North 7 will have 810,908 square feet of space in Fort Worth, and Alliance Northport 2 will have 459,762 square feet in Northlake. Construction will start in September, with with completion scheduled for mid-2020.

2. MCKINNEY LOGISTICS CENTER

SIZE: 1 million square feet

LOCATION: McKinney

DEVELOPER: Core5 Industrial Partners

DETAILS: The Atlanta-based developer plans the industrial park to have four buildings on 65 acres. The buildings will range from roughly 130,000 to 385,000 square feet of space, according to filings with the city. The first 129,914-square-foot building is expected to be ready in the middle of next year.

Under Construction

3. STANLEY BLACK & DECKER

SIZE: 1.2 million square feet

LOCATION: Northlake

DEVELOPER: Hillwood Properties

DETAILS: The new facility will serve as a regional distribution hub for the tool manufacturer and will bring 300 new jobs to North Fort Worth in the AllianceTexas development owned by Ross Perot Jr.’s Hillwood. The building is near Fort Worth Alliance Airport, the BNSF Railway Alliance Intermodal Facility, FedEx Express Southwest Regional Hub, and the UPS and FedEx ground shipping centers. Completion is expected by the end of the year.

4. THRIFTBOOKS

SIZE: 178,000 square feet

LOCATION: Dallas

DETAILS: The largest reseller of used books online is tripling the size of its Dallas fulfillment center, with officials saying the bigger facility and new automation will allow it to process 50 million books a year in Dallas.

5. CARTER DISTRIBUTION CENTER

SIZE: 1 million+ square feet

LOCATION: South Fort Worth

DEVELOPERS: Crow Holdings Capital Real Estate and Rob Riner Cos.

DETAILS: Construction is underway on the project at Joel East and Oak Grove Road. The companies are building a 394,000 square-foot, a 294,000-square-foot and two 187,000-square-foot buildings on the the site. Construction began in the first quarter of 2019. Holt Lunsford Fort Worth is handling the leasing.

MULTIFAMILY

Announced Projects

1. THE REALM AT CASTLE HILLS, PHASE II

SIZE: 312 units

LOCATION: Lewisville

DEVELOPER: Bright Realty

DETAILS: This expansion is the second phase of the current 423-unit Discover at The Realm, a multifamily complex underway in the mixed-use community that includes office, retail, entertainment, single-family, multifamily, and condos. This phase will feature two four-story over podium buildings with high-end amenities.

2. ALTA 289

UNITS: 288 units

LOCATION: Plano

DEVELOPER: Wood Partners

DETAILS: The development is located at 7950 Preston Road and is Wood Partners’ second development in the Plano area in the past five years. The development is near State Highway 121 and Dallas North Tollway.

3. 4302 ROSS AVE.

SIZE: 240 units

LOCATION: Dallas

DEVELOPER: Pollack Shores Real Estate Group of Atlanta

DETAILS: The developer was to break ground in July on the apartment community just east of downtown Dallas on a site that was previously vacant automotive sales lots. The complex is expected to open in early 2021.

4. ALEXAN OAK GROVE

SIZE: 185 units

LOCATION: Uptown Dallas

DEVELOPER: Trammell Crow Residential

DETAILS: The 13-story, 185-unit high-rise tower is being built on Oak Grove Avenue near Hall Street. Units will range from 600 to 2,600 square feet.

Under Construction

5. ECHELON AT THE SUMMIT II

SIZE: 373 units

LOCATION: Frisco

DEVELOPER: Lincoln Property Co.

DETAILS: The project will feature one- and two-bedroom apartments. The complex will be at 3033 Ohio Drive, and the facility is expected to have a WeWork shared workspace.

6. PARK HERITAGE

SIZE: 300 luxury units

LOCATION: Dallas

DEVELOPERS: KDC, Toll Brothers Apartment Living, Seritage Growth Properties

DETAILS: The luxury apartments will be part of a 21-acre, 2 million-square-foot mixed-use developent at the intersection of Preston Road and LBJ Freeway. It eventually will include 1.8 million square feet of office space inside two office towers in partnership with Seritage.

7. KAIROI RESIDENTIAL

SIZE: TBA

LOCATION: Dallas

DEVELOPER: Kairoi Residential

DETAILS: The San Antonio-based developer announced plans for a 12-story high-rise residential building on the former site of the Old Warsaw restaurant on Maple Avenue at Mahon Street. The site is next door to the The Crescent complex.