Owners and landlords across North Texas are working hard to stay competitive in attracting tenants for their office and industrial properties. Lease rates are being driven upward by low vacancy in some submarkets, high construction costs, and rising interest rates, says Kim Brooks, principal at Transwestern. Overall, Dallas-Fort Worth remains a high-octane market with demand continuing to soar. Maps were provided by CBRE.

ON-THE-GROUND INSIGHTS

“Low vacancy in most submarkets, high construction costs, and rising interest rates are the driving factors in increasing lease rates in Dallas-Fort Worth currently. Landlords are spending more capital in their buildings in order to stay competitive in attracting today’s tenants who desire more of a hospitality, amenity-rich environment.”

— Kim Brooks, Principal, Transwestern

“Not every tenant can pay $40 to $50 a foot, so you get pushed out and pushed over to Central—or pushed up Central. So, we’ve seen pricing and occupancy increase from lower Central all the way up, and I think you’ll continue to see that.”

— Greg Grainger, President, Principal, and Co-manager,

Younger Partners Property Services

“Paved trailer parking (which can be converted to outside storage as well) has become a decision influencer for national distributors, who often lease or own their own fleet of tractor trailers, as they search for new industrial warehouse space in Dallas-Fort Worth. For those who do not park their trailers on site, paved outside storage is a precious commodity.“

— Corbin Blount, Director, Lee & Associates

“DFW is one of the hottest industrial markets in the U.S. Our population boom, as well as great state and local governments that are aggressively attracting business to Texas—developers can’t keep up with demand. Vacancy rates have reached historic lows over the past several years, fueling positive rent growth for landlords.”

— Chris Stout, Vice President, JLL

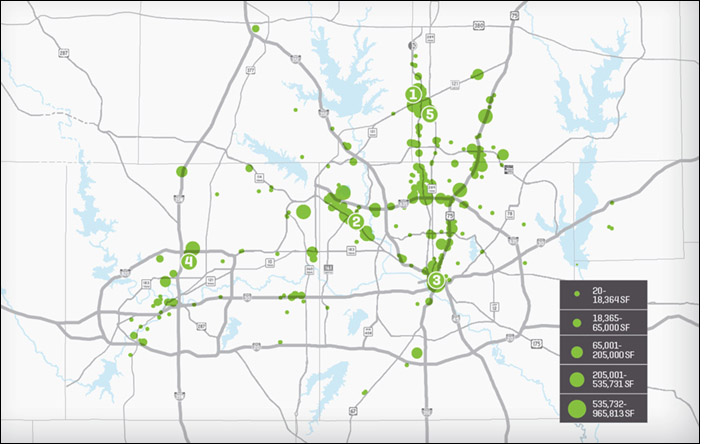

LARGEST OFFICE LEASES

1. KEURIG DR PEPPER

SIZE: 350,000 square feet

LOCATION: The Star

TENANT REPS: Jeffrey S. Ellerman, Seth Kelly, John Ellerman, Robert Blount of CBRE

LEASING AGENTS: Worthy Wiles and Jake Young of Lincoln Property Co.

DETAILS: Recently formed beverage giant Keurig Dr Pepper announced its headquarters hop from Plano to Frisco in February. It’s moving to The Star, marking another Fortune 500 win for Frisco.

2. WEWORK

SIZE: 77,000 square feet

LOCATION: Towers at Williams Square in Las Colinas

LEASING AGENT: Bill Brokaw of Hillwood

DETAILS: Capitalizing on the need for coworking in a burgeoning tech hub, WeWork advanced the tide of coworking washing into the suburbs with a three-floor lease in Las Colinas in early February.

3. KATTEN MUCHIN

SIZE: 56,340 square feet

LOCATION: Park District PwC

TENANT REPS: Matt Craft of Lincoln Property Co.

LEASING AGENTS: Dennis Barnes, Shannon Brown, Clay Gilbert of CBRE

DETAILS: Katten Muchin Rosenman’s two-floor lease–inked in the ides of March–brought PwC Tower’s law firm count to four, lending momentum to the trend of legal services located in the urban core.

4. MID-STATES DISTRIBUTING CO.

SIZE: 40,000 square feet

LOCATION: Mercantile Center in Fort Worth

LEASING AGENT: Colt Power of NAI Robert Lynn

DETAILS: Minneapolis-based retailer Mid-States Distributing Co. announced it would move its headquarters to Fort Worth in mid-March. Its new headquarters building previously housed the American Paint Horse Association, which moved to the Stockyards recently.

5. FIRST GUARANTY MORTGAGE

SIZE: 27,055 square feet

LOCATION: Legacy Place One, 5800 Tennyson Parkway in Plano

LEASING AGENTS: Ward Eastman, Trey Smith, and Johnny Johnson of Cushman & Wakefield

DETAILS: In early March, First Guaranty Mortgage signed a lease in Legacy Place One and announced it would move its headquarters into the Plano office development.

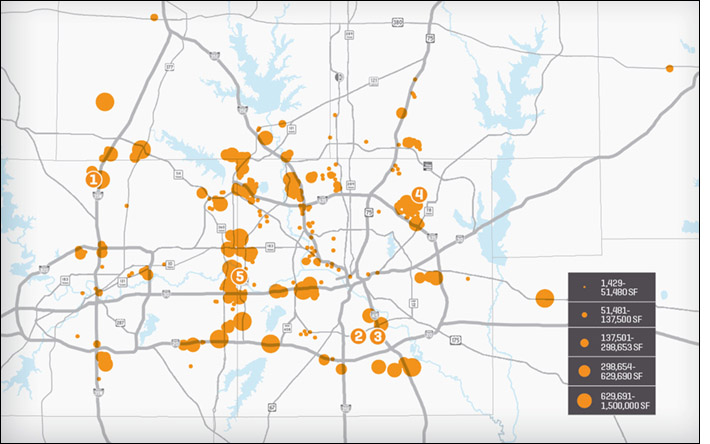

LARGEST INDUSTRIAL LEASES

1. STANLEY BLACK & DECKER

SIZE: 1,279,500 square feet

LOCATION: Northport 3 at AllianceTexas in North Fort Worth

LEASING AGENT: Tony Creme of Hillwood

DETAILS: By far the biggest lease of the first quarter, Stanley Black & Decker brought major absorption to an already booming Alliance submarket. The new distribution center will bring 300 more jobs to Hillwood’s newest Alliance development, Northport.

2. UNDISCLOSED TENANT

SIZE: 1,079,395 square feet

LOCATION: Southport Logistics Park, 1200 Fulghum Road in Wilmer

LEASING AGENTS: Kacy Jones and John Hendricks of CBRE

DETAILS: Though the tenant is undisclosed, it is newsworthy that Southport got another tenant to the tune of 1 million square feet in Q1. This South Dallas logistics hub just across from the UP Terminal is burning up with big wins like Amazon and this 1-million-square-foot mystery tenant.

3. GEORGIA-PACIFIC

SIZE: 1,004,674 square feet

LOCATION: Interchange 20/45 in Hutchins

LEASING AGENTS: Stever Berger and Kacy Jones of CBRE

DETAILS: Another win for the South Dallas industrial market, Georgia-Pacific, took a large stake in Hutchins industrial square-footage with this lease, setting up shop in the 14.29-acre industrial development at Interchange 20/45, three miles from the Union Pacific Intermodal.

4. CTDI

SIZE: 705,955 square feet

LOCATION: Elizabeth Creek Gateway in North Fort Worth

LEASING AGENTS: Nathan Lawrence and Krista Raymond of CBRE

DETAILS: CTDI inked its full-building lease at Transwestern’s newly acquired building in the booming North Fort Worth Alliance submarket, which is known for its pro-business tax rates and access to the BNSF Intermodal.

5. HOLLINGSWORTH LOGISTICS

SIZE: 494,990 square feet

LOCATION: 14900 Frye Road in Fort Worth

TENANT REPS: Noel Hutcheson of Colliers International

LEASING AGENTS: Kurt Griffin and Nathan Orbin of Cushman & Wakefield

DETAILS: Dearborn, Michigan-based supply chain solutions company Hollingsworth Logistics is partnering with the U.S. Postal Service to participate in its Mail Transport Equipment Service Center program and will dedicate 350,000 square feet of this lease to that end.