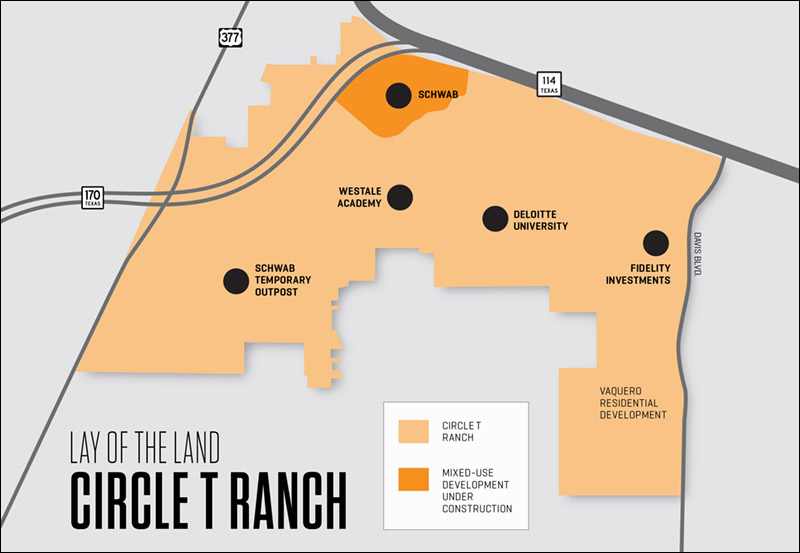

Ross Perot Jr.’s vision comes closer to a reality as Charles Schwab Corp. joins fellow financial giants Fidelity Investments and Deloitte in planting roots at the Circle T Ranch

The Charles Schwab Corp. has called the hills of San Francisco home for decades. But when the financial giant began looking for a place to expand, it found the perfect home on the range, a working cattle ranch where Brangus cattle roam and corporate citizens are welcome — The Circle T Ranch in Westlake.

Schwab’s new North Texas campus will join Fidelity Investments and Deloitte University as major corporate residents in Westlake.

Ross Perot Jr. and his Hillwood real estate development company acquired the 2,500-acre Circle T Ranch in 1993. The big-picture vision has always been one of high-end corporate campuses nestled into and respecting the property’s natural beauty.

“That land doesn’t look like anything else, literally, in North Texas,” says Mike Berry, president of Hillwood Properties and Hillwood Urban. “It’s so unique. It was kept up over the years, beautifully, by the Hunts who ran it as a very upscale horse operation.” Over time, the land was cleared but big, beautiful post oaks were showcased and allowed to flourish, enhancing the ranch’s natural beauty, which includes a lake and rolling hills.

Hillwood believed Circle T Ranch would develop slowly as a quality master-planned corporate campus environment. They were willing to be patient. With Las Colinas just down Texas 114 to the east and Legacy booming in Plano, Hillwood knew it would take time for development to head west. Eventually, growth did come west, and, as a result, the Circle T Ranch has entered the mix as a sought-after corporate campus site.

Schwab began scouting the Dallas area for an expansion in December 2012, and by late 2013, it had zeroed in on the ranch in Westlake, a small town of roughly 1,200 residents that already was home to Fidelity and Deloitte University.

Although it remains committed to its headquarters in San Francisco, Schwab decided about 10 years ago to reduce its headcount there and expand in other select cities after strategizing a long-term growth plan.

Schwab, which has several employment centers around the nation, chose Denver and Dallas as expansion sites.

“It was all about demographics —where can we find the right employees that fit the Schwab culture and have the experience and expertise we need?” says Glenn Cooper, senior vice president of corporate real estate at Schwab. “Several cities arose in our research, but Dallas clearly came up as No. 1.”

Schwab tapped the expertise of CBRE’s Josh White to help it explore options around Dallas, and company officials visited Circle T for the first time in late 2013, meeting with the entire team at Hillwood, which is developing the ranch site.

“We spent the good part of a year getting to know each other,” Cooper recalls. “It was a negotiation, but it was also getting to know each other and making sure we were the right fit for them,” Cooper says. “It was unique in that way.”

FIDELITY KICKS OFF DEVELOPMENT

Hillwood originally envisioned a regional mall at the property’s most visible corner, the intersection of state highways 114 and 170. Hillwood and General Growth entered into a partnership to develop the mall there while allowing for other development within the ranch’s core.

“We had ideas, always heavy with open space. We thought about golf, a resort hotel, [a] low-density corporate campus. We thought about some other uses such as a wedding chapel or a winery,” Berry says. “Over time, we planned those different things, but the vision was always primarily driven by a corporate campus concept to anchor the development, kind of like the early days with Legacy, which Mr. Perot Sr. created with EDS [Electronic Data Systems].”

Although the mall never got off the ground and was eventually removed from the plan, Hillwood landed Fidelity five years after buying the ranch, setting the stage for the future corporate development.

“Fidelity went over and above the call of duty in terms of their respect for the land and their respect for design,” Berry says. The more than 1 million-square-foot campus isn’t visible from Texas 114. “That was a validation that the Circle T needed to be treated as a very special place.”

Scott Orr, vice president of public affairs at Fidelity, says former Fidelity Chairman Ned Johnson drove the decision to consolidate Fidelity’s North Texas operations at Circle T.

“He told stories of flying over the terrain in a helicopter,” he says. “He liked the hills, the ponds, and said, ‘Here’s the land I want—you guys figure out how to put it together.’” Fidelity ultimately bought 337 acres. It initially opened one building in 2000 and its second building in 2010. Fidelity now employs more than 6,000 people at Circle T. “It’s definitely been a very successful outpost for Fidelity. In fact, this is our single largest collection of Fidelity employees in the world,” Orr says.

Johnson made Westlake the first Fidelity facility outside Boston after a massive East Coast snow storm in 1978 made it impossible for most Boston-area workers to make it to the office, crippling customer service efforts. Johnson used cross-country skis to get to the office.

Seeing a need to diversify Fidelity’s locations, Johnson began a search for a place to build a Sunbelt campus.

On the heels of the Fidelity deal, Hillwood worked with Discovery Land and put together Vaquero, a high-end residential development just south of the Fidelity campus. Discovery brought in world-renowned golf-course architect Tom Fazio to design a golf course, which opened in the fall of 2001. The 330-acre project faced some initial challenges because of the recession that followed the 9/11 terrorist attacks, but it persevered and now is substantially built-out.

In 2000, DaimlerChrysler Financial Services built a 130,000-square-foot office building on the west side of the ranch, which would later be occupied by TD Auto Finance. Today, Schwab occupies the building as a temporary outpost. It has 150 employees there and will be able to accommodate as many as 900 as it ramps up employment concurrent with its campus construction.

DELOITTE COMMITS TO CIRCLE T

The next spring, in March 2001, Boeing Co. announced plans to move its headquarters from Seattle to Dallas, Denver, or Chicago. A flurry of media attention ensued as the three cities competed to woo the Fortune 500 multinational company. In North Texas, the Circle T Ranch was among sites Boeing officials toured, but by May the airplane manufacturer had settled on Chicago.

The effort to woo Boeing raised Circle T’s profile on the national stage as a strong and viable location for top-tier corporate relocations, but seven years would pass before the ranch attracted its next high-profile corporate client. In 2008, Deloitte announced plans for a corporate training center, Deloitte University, at Circle T. It opened in 2011.

It was a huge win for Hillwood’s Circle T. The 700,000-square-foot facility contains 800 hotel rooms along with meeting rooms, a dining hall, and a fitness center.

“We looked at a number of locations around the country, some 300 sites,” says Jason Downing, managing partner, North Texas for Deloitte. “It was a very attractive physical site — the property is beautiful, heavily treed, lots of hills, just great space —but probably the No. 1 factor was proximity to the airport,” he says. Deloitte also liked that North Texas was geographically “fair” for professionals traveling from both coasts and had a cooperative climate.

Roughly 60,000 visitors cycle through the center every year for leadership development curriculum, Downing says. Deloitte also offers a program for military veterans transitioning into the workforce, and a weekend development program for school principals.

SCHWAB ANCHORS MIXED-USE DEVELOPMENT

Corgan, which is designing the Schwab campus, said the 70-acre project will include parks, open space, and nature trails — all open to the public.

About 3,500 people are expected to work at the 580,000-square foot Phase One of the Schwab campus. Ultimately, the campus is expected to expand to more than 1 million square feet.

“Charles Schwab wants to be a great corporate citizen, and they want to engage the community,” Corgan Managing Principal Matt Mooney says. The design includes an amenity center with meeting rooms near the front entrance available for civic functions. “They plan to develop a campus that is an asset to the community, engages the public and offers venues and functions for employees and citizens that extend beyond a business use,” he says.

It also includes a park-like feature for public use that will sit alongside a parking garage accommodating 2,600 cars. The Office of James Burnett, which designed Klyde Warren Park, is serving as landscape architect.

Mooney says the campus design will balance a rural ranch aesthetic with a sophisticated commercial image. Corgan will incorporate metal gabled roofs with large shaded overhangs and natural stone veneers. Service functions, such as a loading dock are concealed below grade to not spoil the aesthetic.

Steve Aldrich, senior vice president with Hillwood Properties, says Hillwood will partner with Howard Hughes Corp. to develop a vibrant, urban mixed-use development to complement the Schwab campus.

Howard Hughes Corp. sees a lot of upside to that mixed-use development, says Mark Bulmash, senior vice president of development for Howard Hughes. Based in Dallas, Bulmash oversees properties based in the central and southeast regions of the U.S.

“We believe corporate campuses are looking for these highly amenitized areas — walkable situations with hotels, fitness centers, restaurants, and retail that will create amenities not just for Schwab but for the surrounding communities,” Bulmash says. “Westlake is known for its tremendous quality of life, and Schwab will create momentum for the project and will accelerate other developments that will occur around it. It’s already happening, but I think Schwab is a seminal event for the area.”

Hillwood is already “softly out to market” on the mixed-use project, which it recently took to the International Council of Shopping Centers (ICSC) conference in Las Vegas, says Bill Burton, executive vice president of Hillwood Properties and Hillwood Urban.

Hillwood and Howard Hughes have jointly owned the land for several years, but have never jointly developed anything until now, according to Bulmash.

“We are looking forward to our first venture together,” he says.

“We’ve had a long relationship with the Hillwood people — a very skilled and experienced group. It’s fun to work with others like that and figure out how we will build it together,” Bulmash says.

Gensler is master-planning the mixed-use component with the expectation that construction could get underway by 2018.

“I think there is opportunity to put density in Westlake that exists nowhere else there,” says Barry Hand, principal and studio director at Gensler. Downtown Roanoke and Southlake Town Square are the closest high-density mixed-use developments, and this project will be different, he says. “I think Hillwood and Hughes want to tap into the Circle T Ranch brand, but it won’t be Cowboys and Indians. When we say ranching, it’s more about casual sophistication,” he continues.

The project will attract residents from area cities but also connect to the Schwab campus. “We intend for the corporate citizens at Schwab to be able to walk into this development and use it for a lot of lifestyle amenities,” Hand says. “We talk a lot about the amenitized corporate environment, and in our masterplans, we are putting lifestyle cores against HQ parcels because that is what new HQ relocations are looking for.”

A LOOK TO THE FUTURE

The Schwab campus provided the catalyst for Hillwood to revisit its vision for corporate campus development on the western portion of the ranch, Aldrich says.

“We hadn’t taken a fresh look at the western side of the ranch and the 900 acres we have there in quite a while,” he says.

“We are really starting to look at that in conjunction with the pieces of the ranch that have fallen into place: Vaquero, Fidelity, Deloitte, Schwab, and our mixed-use piece: What can we do with the remainder of that land to attract firms that want to locate in North Texas?”

That revisioning is being finalized with the help of Gensler and will allow for sites as small as 5 to 10 acres or as large as 100 or more acres. “We are figuring out what will fit best on that land and will be refining our story,” Aldrich says. “We are excited about Schwab allowing us to advance the story of Circle T Ranch.”

The History of the Circle T Ranch

Circle T Ranch is unique in that it’s only had a handful of owners over its lifetime and has always been owned by highly influential Dallas business leaders who used the ranch as a family getaway, as a horse or cattle operation, and as the site for sophisticated gatherings of Dallas’ well-to-do society.

Ted Dealey, who succeeded his father as head of Belo Corp., bought acreage in what is now Westlake in the late 1930s and had a home built there in 1938 by famous architect Charles Dilbeck. The property was known as the 220 Ranch for the amount of acreage it contained.

Dealey, who built what is now known as Turner Lake, sold his ranch in the late 1940s to J. Glenn Turner who renamed the property Circle T Ranch and continued to add acreage until it reached about 2,500 acres.

Turner used the ranch to raise and train Tennessee Walking Horses, and as a place for entertaining and respite from Dallas. Turner incorporated the ranch and surrounding area as the Town of Westlake in December 1956.

The ranch was sold in 1969 to Nelson Bunker Hunt, another powerful Dallas figure who raised horses and cattle on the property. Hunt is said to have loved the property so much he once insisted he’d never part with it, even for $200 million, according to a story in the New York Times.

Ross Perot Jr. managed to buy Circle T Ranch in 1993 for less than $20 million after Hunt went bankrupt.

After Perot bought the ranch, former Westlake mayor Scott Bradley — who owned 130 acres adjacent to the ranch including the Dilbeck house that he’d restored — opposed Perot’s development plans, and a feud developed over the Circle T and whether it would be owned by Westlake or disannexed and annexed into the city of Fort Worth.

A multiyear battle with many layers of intrigue eventually was settled with the ranch declared to be in the Town of Westlake.

In 1998, Bradley sold acreage he owned to Fidelity and moved the Dilbeck house to another property about a mile away. In 2000, Fidelity opened its campus, becoming the first major corporate facility on the ranch.

Sources: The Little Town that Could, by Joyce Gibson Roach, The New York Times, The Dallas Morning News.

TIMELINE:

- 1993: Ross Perot Jr. acquires the 2,500-acre Circle T Ranch from Nelson Bunker Hunt

- 1998: Fidelity buys more than 300 acres of land, some from Hillwood and the remainder from Scott Bradley, then the mayor of Westlake

- 1999: General Growth announces a partnership with Hillwood to build a super regional mall (Plans for a mall are later removed in the mid 2000s)

- 2000: Fidelity campus opens its first building, One Destiny Way

- 2000: DaimlerChrysler Financial builds a 130,000-square-foot office

- 2001: Tom Fazio golf course and Vaquero residential development opens

- 2003: Westlake Academy opens

- 2008: Deloitte buys land and announces plans for Deloitte University

- 2010: Fidelity opens Two Destiny Way, bringing its square footage at the ranch to more than 1 million square feet

- 2011: Deloitte University opens

- 2011: General Growth’s interest at Circle T is transferred to Howard Hughes Corp.

- 2015: Schwab announces plans to build at Circle T

- 2016: Hillwood announces partnership with Howard Hughes for a mixed-use development

- Summer 2017: Construction to begin on the Schwab campus

Area Cities Focused on Opportunities

Development on the Circle T Ranch is expected to benefit not only Westlake, where the ranch is located, but also surrounding cities where leaders say they see positive economic impacts on the horizon.

“The vitality of the [State Highway] 114 corridor is something that Southlake and the City Council have been focused on for some time,” says Alison Ortowski, Southlake assistant city manager.

“In fact, in our most recent economic development master plan, we identify several goals related to the development of the corridor in Southlake, including the desire for additional corporate and regional office development.”

Ortowski says the current construction of TD Ameritrade’s regional site in Southlake is an example of Southlake’s vision coming to life.

“We believe we are well on our way to a vibrant, diversified corridor that encourages desired future growth,” she says, “and development in neighboring cities only contributes to the success of the region as a whole.”

Cody Petree, director of community & business development in Roanoke, says he expects many Schwab employees to consider Roanoke for housing and for its amenities, which include more than 50 restaurants, including the original Babe’s Chicken Dinner House and the popular Classic Café. The city is widening Parish Lane, which leads from Texas 170 into Roanoke, in anticipation of the coming growth, he says.

In Westlake, Town Manager Thomas Brymer says they expect Circle T projects will add to the city’s tax base over the course of time after tax abatements run their course. He says some additional executive-level housing likely will be built in town as a result of the Schwab campus.

“In respect to sales tax, I think it will have an impact on communities contiguous and near to Westlake as employees will be living all around the area, not just in Westlake,” he says. “We see (Schwab) as part of our comprehensive plan to attract an industry cluster, which in the case of Westlake, is turning out to be financial services with Fidelity and Deloitte already here, and now Schwab. Over in Southlake, right across the street from us, TD Ameritrade is building a big campus complex. We are getting a critical mass of financial services companies.”

Brymer says Westlake has been pleased with the quality of corporate citizens locating at the ranch, adding that, “Hillwood, to its credit, has been very selective on its development at the ranch. It’s been of the highest caliber.”