GREEN SPACE

Klyde Warren Park Announces Westward Expansion

By all accounts, when Klyde Warren Park opened in 2012, not only did it literally bridge the divide between Uptown and downtown Dallas, it also ignited what can only be described as an economic generator for the city.

A proven gathering and events spot for Dallas residents, Klyde Warren Park expects to welcome its 10 millionth visitor later this year, making it one of the most-visited destinations in Dallas. What’s the park’s economic impact? An estimated $2.5 billion, park officials say.

Now, expect even more economic and social impact for the city as the park has released renderings of its planned westward expansion over the Woodall Rodgers Freeway toward Field Street.

The project will expand the downtown green space 1.5 acres, with construction scheduled to begin in winter 2021 and be completed in mid-2024, according to a statement.

“This much-needed expansion will create more space in the heart of the city,” Jody Grant, chairman of the board of the Woodall Rodgers Park Foundation, said in a statement.

“It will also secure the financial future of the Park by creating multi-purpose space. The project will further enhance the land value around the Park and those taxes ultimately benefit the City and institutions such as our schools and hospitals.”

Officials also announced financial gifts to support the undertaking as well as enhancements to the current park. Included in the expansion project is a three-story, enclosed special events pavilion.

HOT ZONE

Real Estate Firm Recognizes Deep Ellum’s Cool Factor

We all know that Deep Ellum east of downtown Dallas is cool. The area has colorful murals, old buildings, quaint shops, eclectic artists, and good food.

Rideshare tech giant Uber obviously thinks it’s pretty cool too, recently announcing Deep Ellum will be the home of the company’s second-largest campus outside of its San Francisco headquarters. The deal quickly became one of the biggest North Texas real estate moves in recent years—Uber said it’s taking 450,000 square feet of space in a planned tower at The Epic mixed-use development, bringing 3,000 jobs with it.

And now, global real estate services firm Cushman & Wakefield has put a cool stamp on Deep Ellum by including the area among the Top 20 in its Cool Streets of North America report.

Deep Ellum is a place where you could spot a mohawk-sporting artist and a suit-wearing businessperson side-by-side, eating at one of the district’s plentiful restaurants.

In its report, Cushman & Wakefield looks at what’s driving the rise of the hottest retail districts across the U.S.and Canada, giving in-depth info on 100 of the coolest areas.

“While Dallas has many walkable urban districts that may also be considered by some to be Cool Streets, Deep Ellum stands out due to its gritty, authentic feel,” Chris Harden, a director within Cushman & Wakefield’s Capital Markets Group who leads the retail, urban land, and mixed-use investments practice in Texas, said in a statement.

Deep Ellum’s “critical mass” of historic and eclectic architecture, a walkable street grid, and a live music scene, along with entertainment venues, unique culinary offerings, top tech and design firms, strong branding and identity, and contiguous and cooperative ownership throughout help differentiate it from other areas of Dallas.

TECH

Index Says Dallas Among Nation’s Most AI-Ready Cities

Dallas sits at No. 8 in the world and third in the nation in the Global Cities’ AI Readiness Index conducted by The Oliver Wyman Forum, which evaluates how cities are prepping for tech that can disrupt the way we live and work.

The index is designed to help answer the question of “What does urban AI resilience look like?”

The index affirms Dallas’ top place among cities that have embraced AI. For example, Dallas has the Smart Cities Living Lab program in the West End Historic District, which incorporates high-tech—including AI—into its program.

The forum conducted global research on 105 cities across 31 metrics to better understand the potential disruption created by artificial intelligence. —LM

MARKET SNAPSHOT

Sector by sector, DFW continues hot streak

Across the office, retail, and industrial sectors in Dallas-Fort Worth, there are positive indicators that North Texas is still firing on all cylinders, according to market research released by real estate services and investment firm CBRE.

In the office sector, for example, CBRE says the trend of large relocations has become commonplace, with unprecedented movement into North Texas in the past 10 years. Take Uber’s recent announcement that it is moving into The Epic development in Deep Ellum, for example.

Initially taking 167,000 square feet of space, the transportation tech company eventually will occupy 450,000 square feet of space in the mixed-use development. It will be Uber’s second-largest campus outside the company’s headquarters in San Francisco. CBRE notes that with companies such as Toyota North America, McKesson, and Sunoco—among others—choosing to make North Texas home in recent years, the trend should continue.

CBRE notes that Dallas-Fort Worth has seen more than 31 million square feet of positive absorption in the office sector since 2009.

Office building construction also is on the uptick in Q3 of 2019, CBRE notes, with 25 buildings being built in the region. New construction consists of 5,405,110 square feet of new office space with a pre-leased rate of 22 percent. That’s the largest the construction pipeline has been since the third quarter of 2017, CBRE says.

Class A office space again drove the positive absorption of space in Dallas-Fort Worth for the sixth consecutive quarter with 506,989 square feet, CBRE says.

RETAIL STAYS FIT WITH BIG BOX ABSORPTION

CBRE says that big box net absorption increased in the third quarter with numerous Class A and B spaces being taken off the market, with many being filled by fitness and entertainment concepts. CBRE says that more than ten big boxes have been filed by gyms this year alone. For example, Athletic Apex leased 60,000 square feet of space at the former Neiman Marcus store in Fort Worth’s Ridgmar Mall.

The moving forward of the Dallas Midtown project is a positive indicator for that section of Dallas where the fate of the former Valley View Center has been in question for years. Plans call for new retail, upscale apartments, a luxury hotel, restaurants, and entertainment in the area. With the mall’s recent demolition, CBRE says it has seen a slight rise in rents in that area.

CBRE also notes that more retail is coming to downtown Frisco’s Rail District this fall to meet that city’s rapidly growing population.

INDUSTRIAL SECTOR SHOWS CONTINUED STRENGTH

CBRE notes that the third quarter this year marks the 36th straight quarter for positive net absorption for the industrial market in Dallas-Fort Worth with almost 15.9 million square feet of demand posted in the first three quarters of the year. Demand in the third quarter was led by consumer goods, e-commerce, and third-party logistics companies, CBRE says.

Marketwide, the vacancy rate has dropped 41 basis points from the previous quarter to 5.6 percent. That was attributable in large part to large existing vacancies being taken and strong preleasing in delivered buildings. In the third quarter, CBRE says that more than 2.3 million square feet of vacant space in South Dallas was occupied by tenants, dropping the vacancy rate there by 243 basis points to 12.4 percent. South Dallas accounted for 44 percent of all DFW industrial market absorption in the third quarter, CBRE says.

Projects under construction were 27.5 million square feet of space in the third quarter, CBRE notes. Starts were up from the previous quarter from 5.3 million square feet to 9.3 million square feet in the third quarter. Deliveries totaled 5.2 million square feet with a pre-lease rate of 68.6 percent, CBRE says.

CBRE says that despite reports of global economic cooling, the Dallas-Fort Worth economy remains strong.

OFFICE

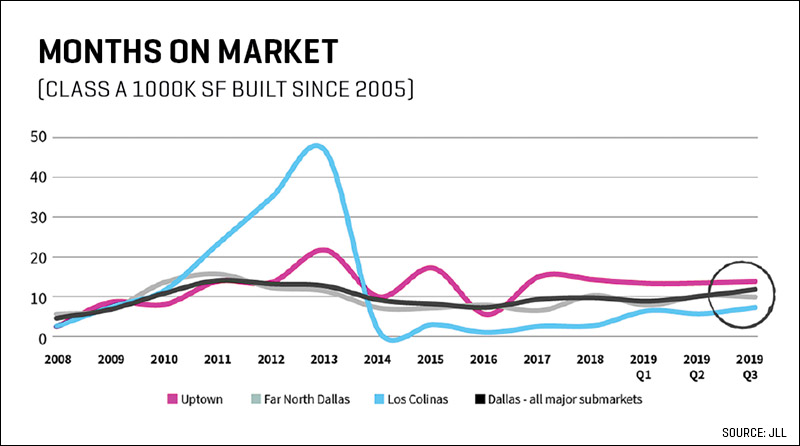

Months on market stable, suggesting demand for modern office space will remain strong

Office vacancy has decreased considerably through this cycle. As of the third quarter, Class A vacancy averaged 20.6 percent in Dallas. For some of the submarkets seeing significant new development, this rate is even lower. Uptown, Las Colinas, and Central Expressway have Class A vacancy in the mid-teens, with Preston Center coming in at sub-10 percent.

One important market driver is that these rates have been stable for several years at this point in the cycle. A byproduct of this “tightness” is that the time space sits on the market for lease has declined

As we have reported in the past, some of Dallas’ space built in the 1980s and 1990s is functionally obsolete by today’s tenant standards—and sits unleased for extended periods. Modern space, however, is in high demand. Larger Class A buildings, developed since 2005, have space on the market available for lease averaging just 12 months, with popular submarkets that have seen significant new development at 7 to 10 months.

While higher than 2008 due to the new development taking place, months on market has been very stable the last few years, even as new projects have delivered in these submarkets.

TALENT ATTRACTION

Study: Dallas-Fort Worth has what it takes to attract millennials

Analysis of 2017 U.S. Census data illustrates that migration patterns of millennials are being driven by job opportunities, affordable housing, and quality of life.

That’s according to a Snapshot from JLL, which says that Dallas-Fort Worth ranks No. 1 out of all cities examined for the study, while Texas was the second-ranked state behind Washington.

JLL reports that Texas and the DFW area have created a significant number of jobs, with DFW seeing five-year job growth at 23 percent. Since 2010, the Dallas metro has added more than 900,000 jobs.

Career opportunities are crucial, but they’re not the only part of the millennial migration formula.

JLL says affordability directly affects quality of life and an area’s “livability.” Texas and DFW are directly cited as having major advantages because of “their dynamic economies that drive above-average incomes.”

The average millennial household income for the DFW metro is $80,300, while the income goes up to $137,700 in San Jose and is as low as $66,700 in Memphis.

Despite DFW having an average household income, JLL says millennials in Texas have an advantage of up to $9,400 in spending power over the national average, after it accounted for the cost of living.

Texas and DFW’s lower cost of living is a draw for millennials seeking to move up in the workforce.

INNOVATION

Fort Worth’s Near Southside Preps as Medical, Innovation Hub

Earlier this year, Dallas Innovates reported on plans Fort Worth leaders have for a first-of-its-kind medical innovation district south of downtown, an ambitious undertaking that could attract medical-related enterprises to the city and potentially could become an innovation hub. A recent JLL report shows just how much the Near Southside has grown over the years—with the potential to become a major medical hub.

The city’s plan would connect existing medical institutions and organizations with startups and incubators with hopes to attract thousands of additional healthcare and technology-related jobs to the area, according to JLL’s report.

The Near Southside is already home to major healthcare centers such as Cook Children’s Healthcare System, Texas Health Harris Methodist, Baylor Scott & White, and Medical City Fort Worth.

In the report, JLL examines the history and future of the 1,400-acre area. JLL refers to the Fort Worth district as “an emerging mixed-use district” where some of the city’s newest retail, office, and multifamily housing projects are located. The area has roughly 30,000 people employed within its boundaries, making it the second-largest employment center in Tarrant County outside of downtown Fort Worth.

The Near Southside area was first developed in the early 1900s in the area north of the Fairmount residential neighborhood. A nonprofit, member-funded organization called Near Southside Inc. was formed in 1995 to look after the area’s development.

The nonprofit also manages Tax Increment Financing (TIF) District No. 4, which was created in 1997 to help with revitalization efforts.

In the ensuing years, the Near Southside has seen major economic growth. The district’s taxable value was $229.7 million in 1997 and $729.3 million in 2017, according to JLL. The district is projected to have increased its base value by just over 350 percent to over $1 billion by fiscal year 2024.

Infrastructure in the area has been improved with the 2014 retrofit of West Rosedale Street from a six-lane road to a four-lane street with bike lanes, on-street parking, and pedestrian improvements. An $8.5-million reconstruction of South Main Street also happened last year.

The Hemphill-Lamar Connector, a $53-million tunnel under Interstate 30 with rail lines providing another downtown route, is scheduled to open in 2020.

Housing in the area has also seen growth in recent years with roughly 2,000 multifamily units having been built since 2000 and three more currently under construction. On top of this, an additional 300 units have been proposed, including a 10-story mixed-use project.

A proposed 2.1-mile extension of TEXRail southwest would add a new station to serve the major hospitals in the Near Southside. Those hospitals provide a major economic and employment base for the area, according to JLL.

According to a 2014 study by the University of North Texas, the healthcare facilities have an annual economic impact of $4.2 billion for the city of Fort Worth and $5.5 billion throughout Tarrant County.

Robert Sturns, the economic development director for the city of Fort Worth, told Dallas Innovates earlier this year that the hope is Near Southside would “become the most livable medical district in the U.S.”

Creating a medical innovation district was a key finding from the Economic Development Plan accepted by the City Council at the end of 2017. The plan’s goal is to compete successfully on the national and international stage for “creative, high-growth businesses and the talented individuals who fuel them.”

The University of Texas at Arlington’s Center for Transportation, Equity, Decisions and Dollars was contracted to study the district’s needs and strengths, and Schaefer Advertising is expected to develop messaging and a brand for Near Southside Inc.

Near Southside has been a focus of innovative thinking in placemaking for years. The Brookings Institute’s global urbanization specialist Bruce Katz noted in 2016 that the area was “one of the most eclectic micro-economies I’ve ever encountered,” featuring everything from cultural and fine arts to hospitals and beer and whiskey manufacturing.